A high-end insurance broker portal for those who live on a yacht 9 months a year.

GrovesJohnWestrup

The challenge

Making insurance sexy again!

Insurance is occasionally perceived as the ugly cousin of Wealth Management. Munich Re and a visionary team of experts decided to change the game and provide a high-end broker portal for the ultra-rich under the umbrella of a new brand: GrovesJohnWestrup.

Before we joined, the team has been working on a functional prototype to help their idea come to life. But simply the look & feel and the usability did not generate a truly premium user experience for the super rich and their demanding brokers.

This is where we came into play.

How might we re-invent insurance for brokers and their high-net-worth clients in the UK?

Design challenge

The approach

A mood board and design study

to explore a common understanding of what a “premium” experience truly is. A high-end insurance broker portal for those who live on a yacht 9 months a year.

«The mood board and some concrete screens to show us how our solution will look like, convinced us quickly that we found the right partners for this adventure.»

Martin Thormälen, IT Architecture Lead

User research

With close to no access to the ultra rich…

my main source of user insights were under writers who typically deal closely with the brokers, our secondary persona.

Besides understanding how the work of brokers actually work, I was mostly interested in identifying what motivates brokers to sell insurance covers to their ultra rich clients and in what context this happens.

I derived a few insights that help me getting a direction to explore the various user scenarios and flows. In order to share the crafted insights with the entire team, stakeholders and 3rd party providers, I crafted a persona of the typical broker.

«Some of these rich clients are difficult to meet face-to-face as some of them are sailing 9 months a year.»

Stuart Bromley, Senior Underwriter

The insights

Our key insights in a nutshell

Brokers identify themselves strongly with their clients and their life style

Brokers were surprisingly not very tech savvy and mostly care about a great usability so their “paper work” can be done efficiently

What they really care about is interacting with clients and explore their needs and provide best-in-class service

They mostly meet their clients on phone or video call as their clients often are spread across the globe

They were reacting very positively about the idea of providing a complete view on the insured assets comparable to Asset Management

Ideate

Overlook your insured assets just like an investment portfolio

In terms of ideation, I could rely a lot on the future CEO's vision to re-invent the insurance business by offering multi-risk insurance, reducing manual paper work and providing a shiny user interface.

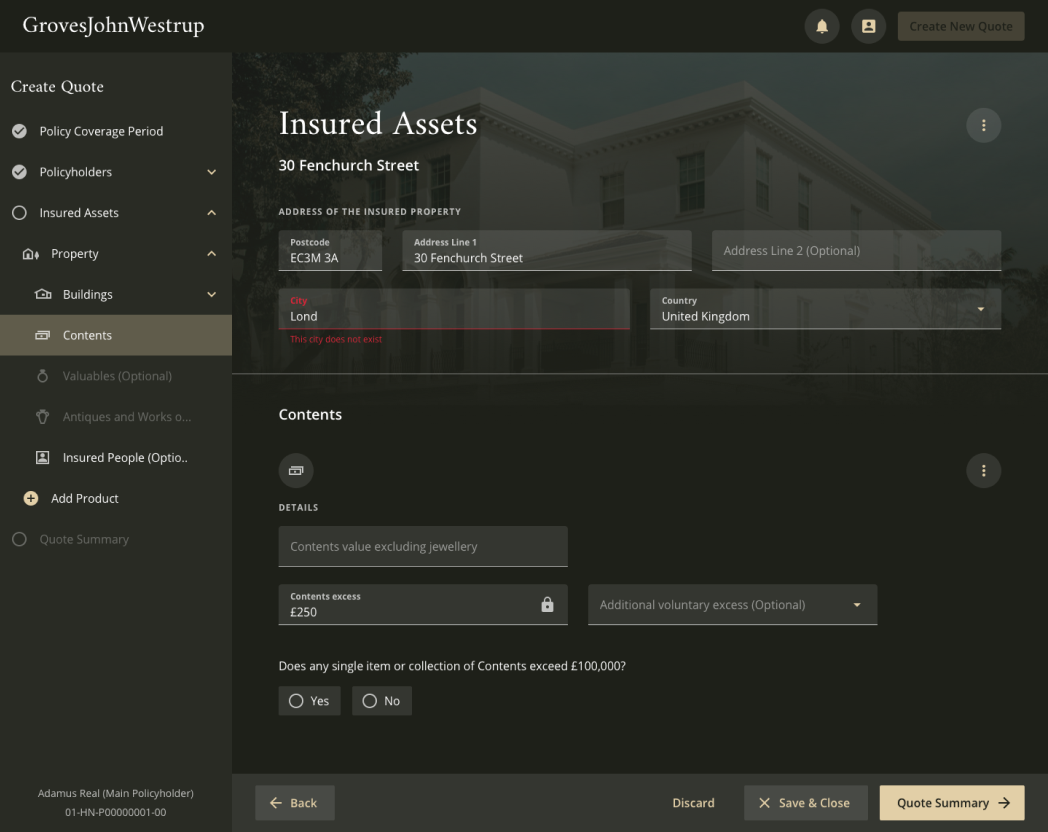

Together with the Business Analysts and the Solution Architect, I crafted a sitemap illustrating the information architecture with its key screens. This helped us to get a common understanding of which bits and pieces need to be in place. The sitemap also helped me to ran through scenarios such as "creating a new quote" or "amending an active policy".

«Insurance is often looked at as the ugly cousin. We want to change this perception and offer brokers and their clients a way to overlook their insured assets like a portfolio at their bank.»

Alex May, CEO GrovesJohnWestrup & driving force

Prototype & validate

Once the journeys and user flows of the main scenarios were defined,

I started prototyping the screens for each of the scenarios. Having the Underwriters and Business Analysts close by allowed me rapidly conduct iterations continuously and refine clickable prototypes.

An Underwriter new joiner served as our (only) external tester. Ultimately, the clickable prototypes were a great mean to discuss the user flows, data inputs, and functionality with the 3rd party provider.

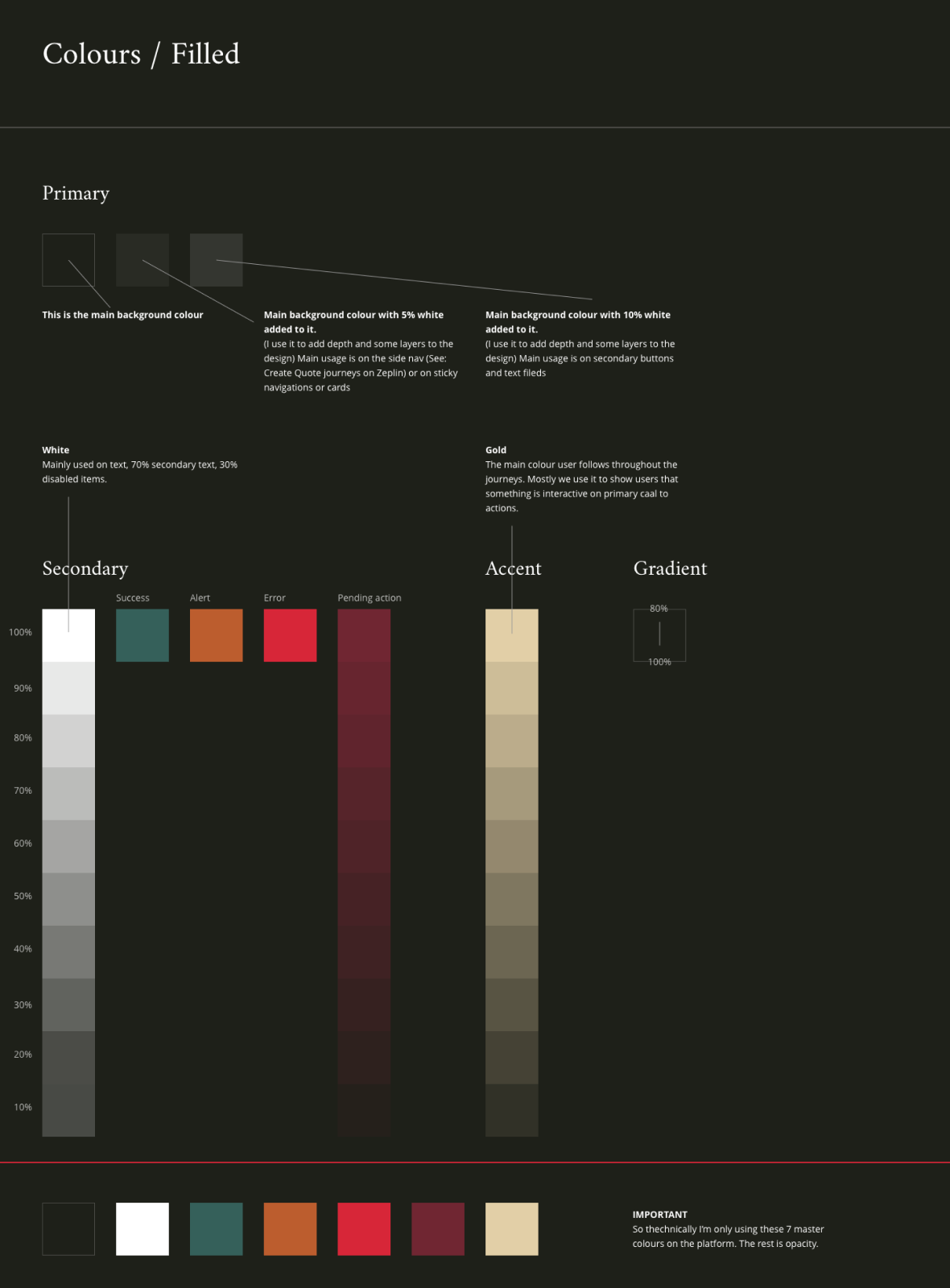

UI Design

UI Design to convey a premium experience

- and further refine the user experience.

While I gathered business requirements from the Underwriters and Business Analysts, the iterations with the UI Designer were very fruitful, too. We cleaned up the screens, created consistent patterns which had a positive impact of the various user flows.

«The mood board exercise was so inspiring, I love it. The board we created is still my background image on my laptop.»

Martin Thormälen, IT Architecture Lead

The outcome

Today GrovesJohnWestrup is successful and rentable daughter company of Munich Re.

And probably most importantly, it’s keeping its innovative DNA in the organization.